Someone who is new to GST?

Well, then here is a quick introduction to get you started.

What is GST?

The Goods and Services Tax (GST) is a tax placed on the things people buy with money or things people do for money.

It is a single tax that encompasses several indirect taxes that were previously levied on the sale of goods and services. It was first introduced in 2017 and has 4 types.

We know that an item goes through multiple stages: Starting from manufacture until the final sale to the consumer. GST is levied on each of these stages making it a multi-stage tax.

GST with an example

Let us keep it simple considering it from the consumer end alone, inline with this task.

From the consumer’s point of view, consider a scenario where a product is priced at Rs. 110. If the Goods and Services Tax (GST) applied to this product is 10%, the tax is calculated on the base price of the item. Here, 10% of Rs. 100 is Rs. 10. Adding this GST amount of Rs. 10 to the base price of Rs. 100 results in the final price of the product being Rs. 110.

GST implementation

GST is designed as a progressive tax collection system where not all goods and services are taxed equally. While some goods and services are exempt from GST, there are goods that are taxed nominally (e.g., essential goods) and some that incur premium charges (e.g., luxury goods).

The recent Next-Gen GST Reform, which was implemented with effect from 22 September 2025, has introduced several significant changes. These reforms are designed to benefit individuals and organisations across a variety of sectors.

Exploring Percentages: An Applied Task

Here comes a task designed to help us engage with the topic by examining different scenarios in terms of percentages. Through this activity, we will deepen our understanding of how percentages are used in various contexts and develop our ability to interpret and manipulate percentage-based information.

Note: As always, the main intention of the task is not to find the correct answer, rather to help reason out efficiently using better strategies.

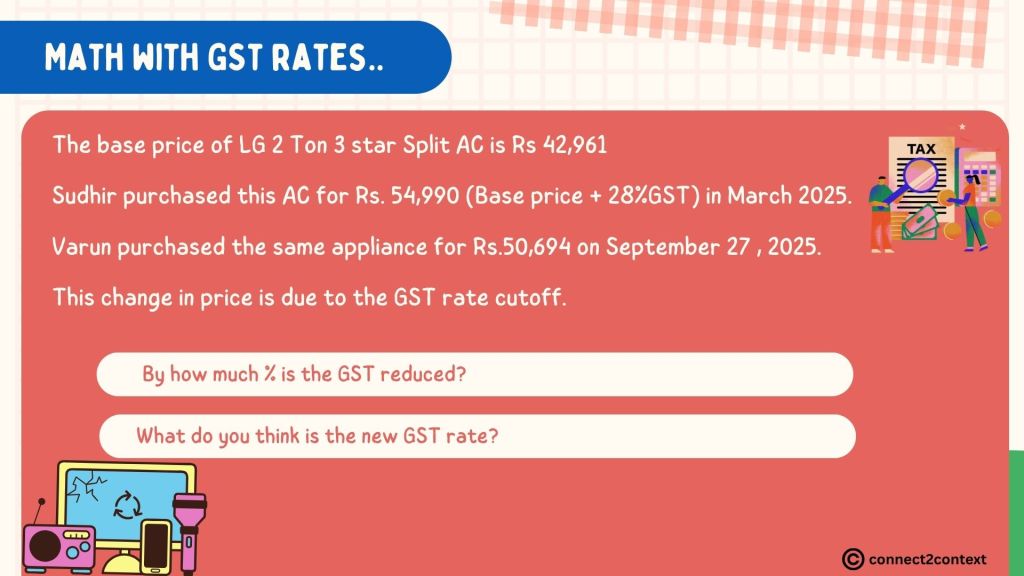

Scenario 1

Reasoning:

Using the strategy A (in Fig 1.2), we calculate how much percentage of Rs 42961 is Rs 7733

We could see that Rs 7733 is less than 25%

Hence, the percentage change is less than 25%.

Modelling helps makes our thinking visible. Modelling this scenario in terms of 20% or 10% splits (as in Fig 1.3) ,enables easy calculation.

As we can see in the image 1.3 above, the tape diagram with 10% splits, helps us narrow down to the answer precisely.

Rs.7733 is slightly less than 20%.

Now let us try using Strategy B as in Fig 1.2.

We see that the difference in GST amount is Rs. 12029 – Rs. 7733 = Rs. 4296

Let us try to see how much % of Rs 42961 is Rs 4296

Rs. 4296 is 10% of Rs. 42960 (rounding off 42961)

Hence, the GST rate is cut by 10% (from 28%) , making the new GST rate as 18%

How else could we reason this out? You can let me know in the comments.

Scenario 2

Reasoning

Rs 9,99,000 can be approximated to 10,00,000 and the price cut of Rs. 1,04,101 can be approximated to Rs. 1,00,000

1 lakh is 10% of 10 lakhs, which leads us to the answer of 10% cut in GST rate.

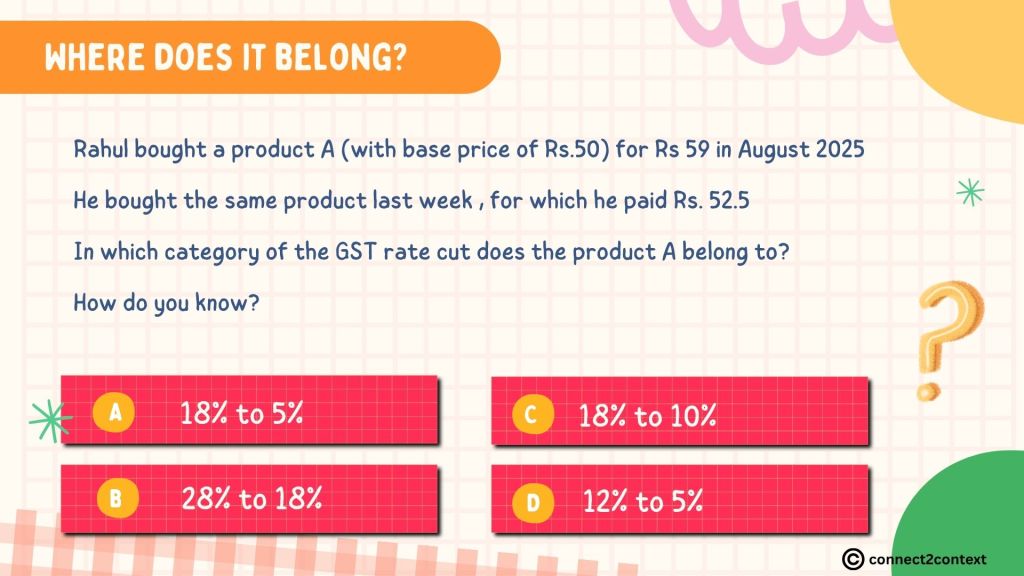

Scenario 3

Reasoning

Old GST rate: 10% of Rs 50 is Rs 5; So, 20% of Rs 50 is Rs 10

Here, for the GST amount Rs 9 (slightly less than 10) added to the base price Rs 50, the rate of GST should be slightly less than 20% (which is 18%; as 2 % of 50 = Rs 1)

New GST rate: 10% of Rs 50 is Rs 5; So, 5% of Rs 50 is Rs 2.5 (new GST amount added to the base price)

Hence, the GST rate has been cut down from 18% to 5%

scenario 4

Reasoning

Total price = Base price + 40% of base price; Options A , B and C represent the same in different arithmetic ways

Only option D does not belong.

Hope you enjoyed exploring percentages!

Here is a infographic detailing the reform changes.

Let us continue exploring “Math in Context” as we shop!

Credits: v3cars, Reliance,CBIC India, Canva

One response to “Math with GST 2.0”

Well explained and compiled !

LikeLike